Masen explores

INVESTMENT TRENDS IN RENEWABLE ENERGIES: INSIGHTS FROM 2016

“Global trends in renewable energy investment” is the title of the latest annual report published jointly by UN Environment, Frankfurt School-UNEP Collaborating Centre and Bloomberg New Energy Finance (BNEF). In their review of 2016, the authors highlight the increasing profitability of clean technologies, which are “getting less and less expensive [and which] provide a real opportunity for investors to get more for less”, as explained by Erik Solheim, Executive director of UN Environment.

Investment trends in renewable energies: insights from 2016

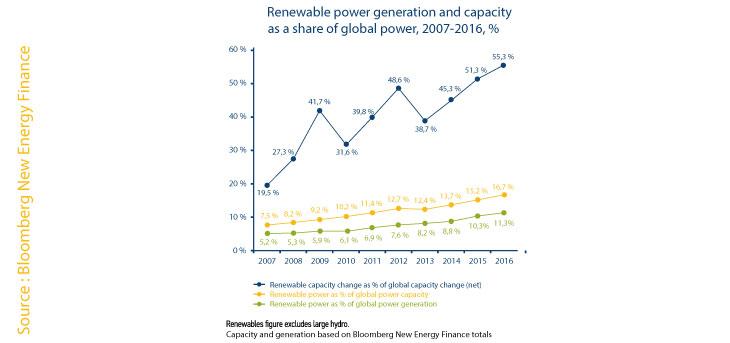

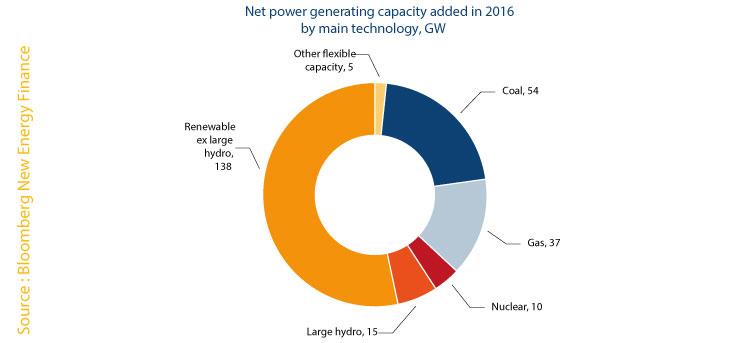

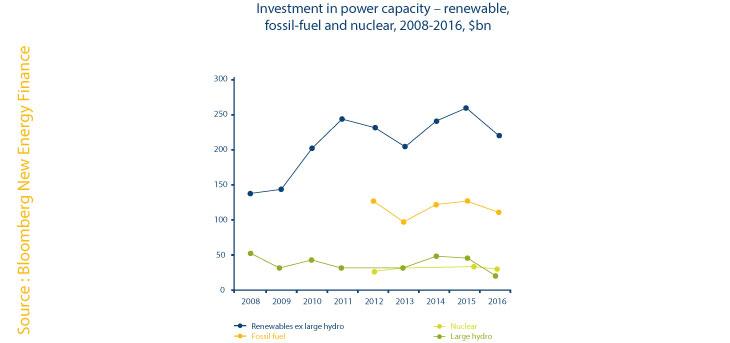

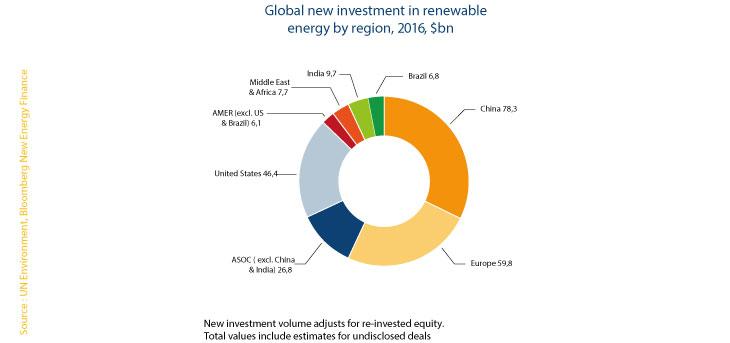

A new record set for new renewable capacity, with the installation of 138 GW in 2016 alone (+ 9% YoY)[1]. This trend contrasts with the drop in investment in renewables, which fell to 242 billion dollars in 2016 (- 23% YoY)[2]. Viewed over a longer period of time, these investments are still relatively stable and have remained in the range of 240-300 billion dollars since 2010, while renewable capacity has seen sustained growth. The steep fall in the cost of renewable projects, aided by technological advances and economies of scale, is behind this trend, which is becoming more pronounced year by year.

The share of renewables in new production capacity has never been as high (55% in 2016) and exceeds that of fossil fuels. Similarly, almost twice as much was invested in renewables than in fossil fuels.[3] This has resulted in renewable energies making up an increasingly significant proportion of global electricity production (11% in 2016), and has led to 1.7 gigaton of CO2 emissions being saved.

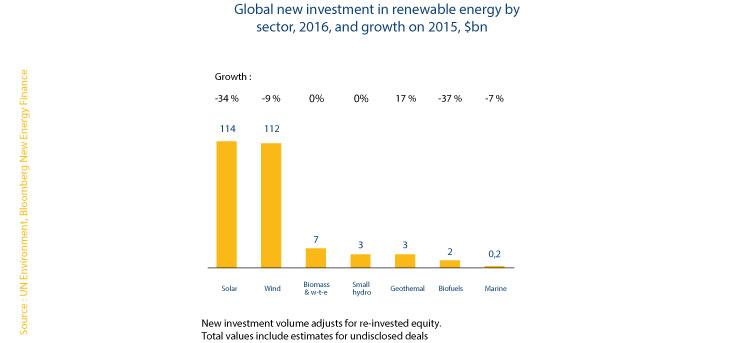

Solar and wind energy accounted for almost all investment in 2016, with 114 billion dollars (- 34% YoY) and 112 billion dollars (- 9% YoY) respectively. Solar capacity set a new record with 75 GW installed in 2016, while wind energy – with 54 GW installed – was slightly below the previous year’s record of 63 GW. The wider use of auctions and invitations to tender around the world has encouraged record tariffs in electricity production from renewable sources: 2.91 c$/kWh for the SolarPack project in Chile and 3 c$/kWh for the 850 MW onshore wind power projects in Morocco.

[1] Excludes large hydro (over 50 MW) with an estimated increase in installed capacity of 15 GW in 2016.

[2] Excludes large hydro projects (over 50 MW), which gained 23.2 billion dollars (- 48% YoY) of investment in 2016.

[3] For several years, investment in renewables has been outstripping that in fossil energies.

China – the leading market for renewables – installed almost half of the world’s new renewable capacity in 2016, equating to 64 GW (compared to 66 GW in 2015). Its investments in renewable energy for the same year increased to 73 billion dollars, considerably outstripping that of the United States (30 billion dollars). However, China is now seeing a sharp slowdown in its investments (- 34% YoY) – for a number of reasons – the impact of which is being felt globally.

The report also focuses on trends relating to finance and specifically the situation regarding green bonds. Twice as many were issued than in the previous year, reaching a total value of 95 billion dollars in 2016.

Another focus of the report is hybrid renewable projects (co-located plants with two or more renewable technologies), which are shown to have huge potential in terms of synergies from optimizing power generation. Currently, a total of 5.6 GW of hybrid renewable projects (over 10 MW) are operational or under development worldwide. Among these, the largest project currently in operation is located in China and combines a 1.3 GW hydroelectric power plant with a 530 MW PV plant, with production from the first plant helping stabilize production at the second. The report refers to the Noor Midelt I project in Morocco, which will combine PV and CSP technology with thermal storage. This high-potential trend for hybrid renewable energy projects is in line with the positive signs from 2016 regarding the increasing integration of green energy sources – which are now competitive – in national electricity production systems.

Investement trends in renewable energies: insights from 2016

Download